White Papers

Recurrent Industry Research

Recurrent Midstream: More than just Dividend Yield (July 2023)

In a higher-rate world, dividend yields are stuck at "junk" bond levels. It is surging midstream earnings growth that will help underpin future total returns in the ongoing midstream recovery.

The objectives laid out in our previous white papers – debt reduction and capex restraint – are largely achieved. Despite the best credit profile in 20 years, midstream dividends are stuck near “junk” bond yields. A singular focus on dividends has led investors to ignore rapid midstream earnings growth – the driver of the next leg of the midstream recovery.

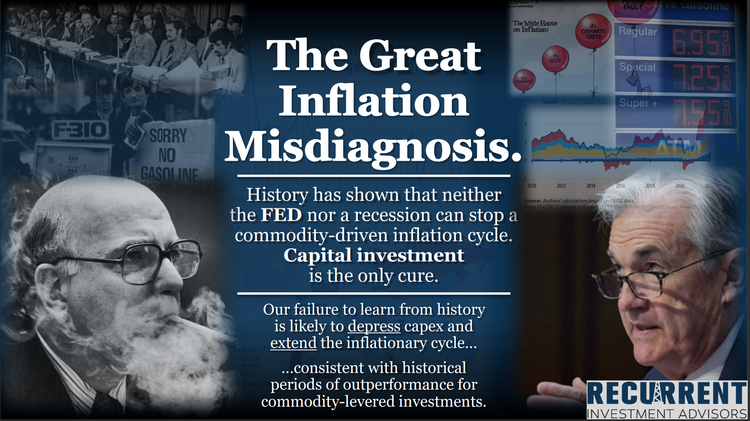

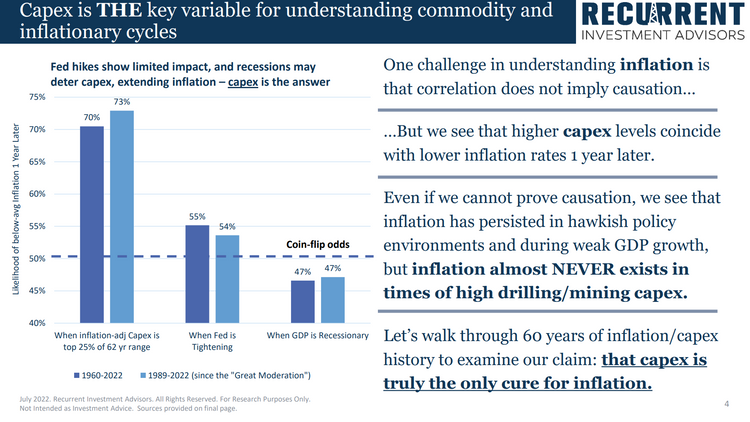

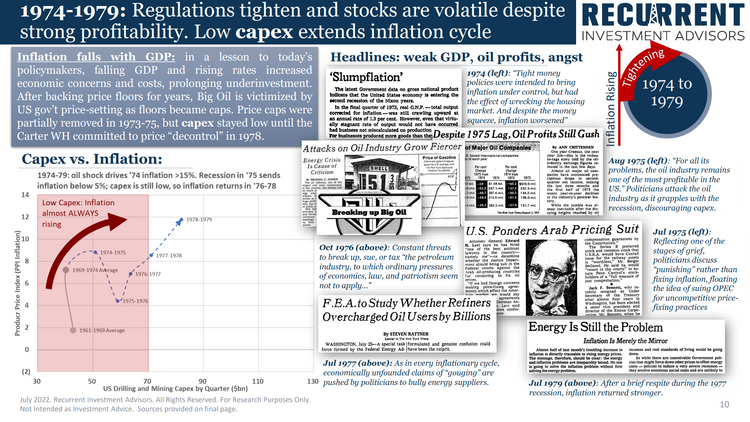

Recurrent: The Great Inflation Misdiagnosis (July 22)

GDP growth and Fed policy have almost no long-term relationship with inflation and commodity prices. Why does the market persist in believing the Fed will put an end to commodity-driven inflation? We use a detailed 62-year case study of inflation to show that only commodity capital investment (drilling and mining capex) can put a definitive end to commodity inflation.

Today’s capex lags the inflation rate at a magnitude not seen since the commodity shortages of the early 1970s. The economic, political and investment climate is as discouraging for new investment as the recessionary price control era of 1972-1975. As long as underinvestment persists, inflation has historically been elevated, while the commodity-levered sectors where Recurrent invests – such as energy and natural resources – have tended to historically significantly outperform broad equity markets.

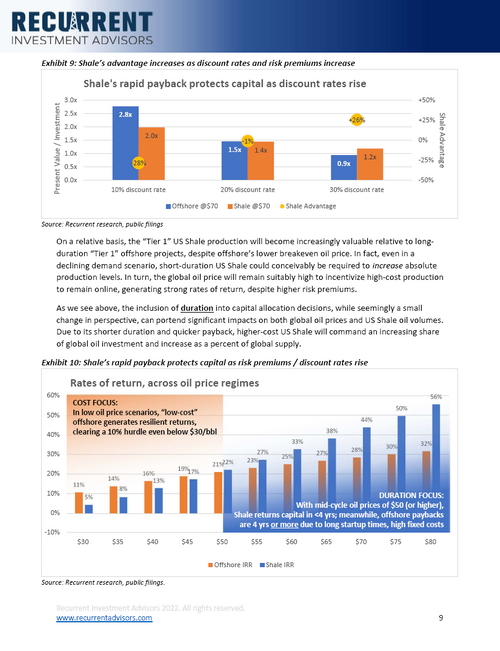

Recurrent on Oil: The Energy Transition Becomes a New Dawn for US Shale (Feb 22)

Many forecasts have presumed that the “Energy Transition” to renewables and EVs will disproportionately hurt high-cost oil supplies, like US Shale. This week, NY’s state pension divested from Shale, citing its unfavorable high-cost position in a low-carbon future. We explain that this “anti-Shale” view mischaracterizes the future of the oil market. With higher costs of capital for new oil projects, time is replacing cost as the dominant variable in project planning. Higher “risk premiums” favor Shale’s 1-3 year paybacks, making low-cost, multi-decade megaprojects impossible to fund. Megaprojects with lower per-barrel costs will lose out as companies seek the quickest payback periods. Shale will become the preeminent source of global supply in the decade ahead.

Recurrent Midstream: The Virtues of Slower Growth (Jun 2020)

The third installment in our series of midstream white papers pivots to an underappreciated fact about the midstream sector: shale-driven growth has not been good for midstream investors. In fact, industry growth has been negatively correlated with equity returns. Accordingly, investors should not be concerned that Covid will end the "midstream growth era" - investors should be celebrating this fact. Slow growth and high free cash flow has been strongly correlated with strong performance in other sectors, and we believe midstream is ideally-positioned to emulate the examples of other capital-efficient sectors, from tobacco to tech.

Recurrent Midstream: The Journey Back from "Junk" (Jul 2019)

One year after publishing our groundbreaking white paper on the midstream/MLP balance sheet recovery, we examine the progress made by midstream companies in repairing balance sheets, the nascent credit rating upgrade cycle, and weigh expectations for future performance as midstream companies and MLPs reach the crucial crossover point back to investment grade metrics.

Recurrent Midstream: From Balance Sheet Recession to Recovery (Jun 2018)

Exploring how master limited partnerships became master leveraged partnerships - and how the reversal of this decade-long trend could drive a 30-50% recovery

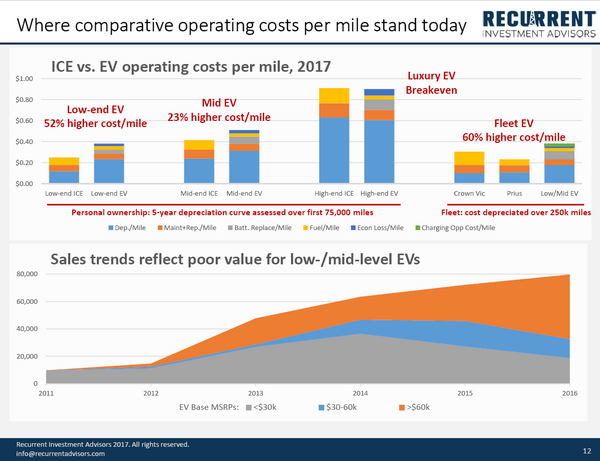

From Gasoline to the Grid: Recurrent on the Rise of the Electric Vehicle (Aug 2017)

It is often taken for granted that technology is deflationary - that is, it drives down our cost of living over time.

In this white paper, Brad Olsen discusses how electric vehicles will fail to measure up to the cost-saving innovations of the past, and how the transition to an increasingly electric future is likely to strain our grids, create mineral scarcity, and increase our cost of living - all while making oil more competitive.

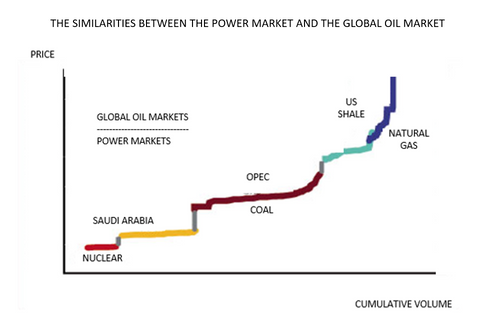

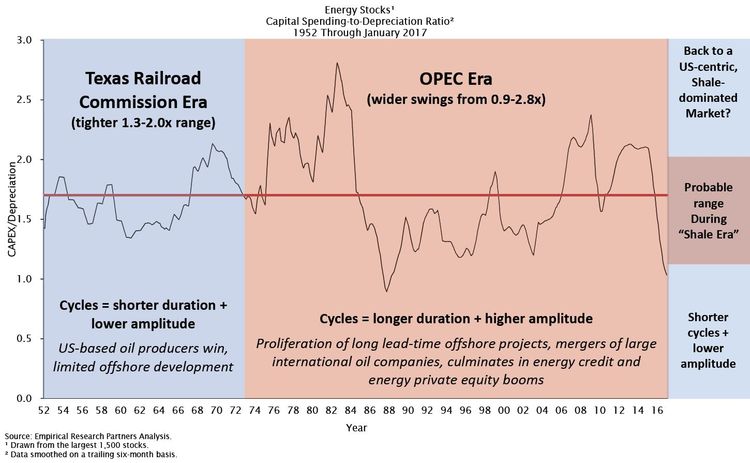

RECURRENT ON OIL: The Impact of Shale on Energy Cycles (Jan 2017)

In this white paper, Mark Laskin outlines the unique attributes of shale production in the global oil market, and its impact on oil cycles in the future.

Our principals’ past energy research has included some of the following topics:

- Oil Supply in a “Dispatch Curve” framework: US shale as the new “peaker plant” for global oil (Laskin, 2016, BP Capital Fund Advisors)

- A return to shorter oil cycles and a US-centric market following the end of the OPEC era (Laskin, 2015, BP Capital Fund Advisors)

- The End of the Northeast Premium – a prediction of prolonged bear market for Northeast US gas (Olsen, 2013, Tudor, Pickering, Holt & Co.)

- Coming sea change for NGL prices due to insufficient petrochemical demand (Olsen, 2011-12, Tudor, Pickering, Holt & Co.)

- Changes in the relationship between stocks and oil price before and after the 1983 oil crash (Laskin, 2006, Morgan Stanley Investment Management)

- The seasonal impact of gasoline demand on the price of WTI in the mid-2000s (Laskin, 2005, Morgan Stanley Investment Management)